Launching a startup often requires significant capital, but securing funding from investors can be challenging, especially in the early stages. Many entrepreneurs find the process of pitching to venture capitalists or angel investors daunting and time-consuming. Fortunately, there are numerous alternative avenues for funding your startup without relying on external investors. This article explores ten practical and effective strategies to fund your startup without investors, providing you with the resources you need to launch and grow your business independently. Learn how to bootstrap your venture, leverage revenue-based financing, and explore other innovative funding options.

Securing startup funding is a critical hurdle for many entrepreneurs. While traditional investor routes exist, exploring alternative methods can be equally effective and often more advantageous in maintaining control and ownership of your company. From bootstrapping your operations to utilizing crowdfunding platforms, this guide outlines ten diverse ways to fund your startup without investors, empowering you to pursue your entrepreneurial dreams with greater financial freedom and flexibility. Discover the power of pre-selling, explore the benefits of small business grants, and unlock the potential of customer financing as viable alternatives to traditional investment models.

Why Bootstrap Your Startup

Bootstrapping your startup offers several compelling advantages, especially in the early stages. It essentially means building and growing your business with minimal outside investment. Control is a key benefit, as you retain full ownership and decision-making power. This allows you to pivot and adapt quickly without needing approval from investors.

Financial independence is another important factor. By relying on your own resources, you avoid debt and equity dilution. This can be particularly attractive to entrepreneurs wary of relinquishing portions of their company. Bootstrapping encourages resourcefulness and efficient capital allocation, fostering a lean and adaptable business model.

Furthermore, bootstrapping forces you to deeply understand your market and customers. Focusing on revenue generation from the outset helps you validate your business idea and achieve profitability sooner. This organic growth builds a strong foundation for future scaling and potentially makes your startup more attractive to investors down the line, if and when you decide to seek external funding.

Benefits of Self-Funding

Self-funding, also known as bootstrapping, offers several key advantages for startups.

Firstly, it provides complete control. You retain full ownership and decision-making authority, without external influence from investors. This allows you to steer the company’s direction and strategy according to your vision.

Secondly, self-funding can lead to greater financial discipline. Necessity breeds resourcefulness, and bootstrapping encourages careful budgeting and spending. This fosters a lean and efficient operation from the outset.

Finally, self-funding can be a powerful motivator. Investing your own resources creates a deep sense of personal commitment and drive to succeed. This passion can be a crucial factor in overcoming early challenges and building a sustainable business.

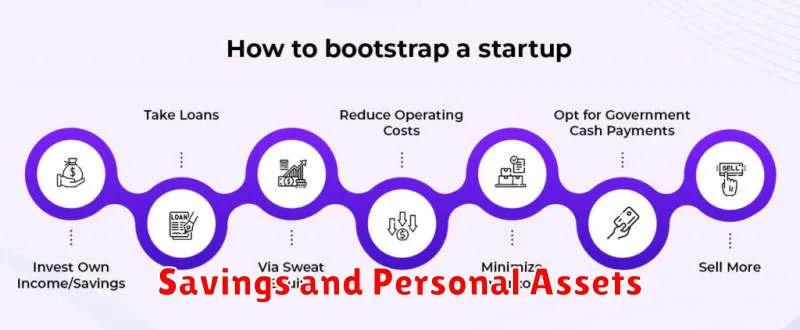

Savings and Personal Assets

One of the most common ways to initially fund a startup is through personal savings. This demonstrates a strong commitment to your venture and reduces reliance on external funding in the early stages. Bootstrapping with personal funds allows you to maintain full control and ownership of your company.

Beyond cash savings, consider other liquid assets such as stocks, bonds, or mutual funds that can be converted to cash. Carefully assess the potential impact on your personal finances before liquidating any assets.

Important Considerations:

- Create a realistic budget to understand your startup’s financial needs.

- Maintain a personal emergency fund separate from your business finances.

- Consult with a financial advisor to explore the tax implications of using personal assets for business purposes.

Freelancing to Build Capital

Freelancing offers a flexible and accessible method for generating startup capital. By leveraging your existing skills, you can offer services in fields such as writing, design, web development, or marketing. This allows you to earn income while simultaneously developing valuable experience.

Key advantages of freelancing include the ability to set your own hours and control your workload. This autonomy allows you to balance income generation with the demands of building your startup. Furthermore, freelancing can provide valuable networking opportunities and insights into your target market.

Effective time management is crucial for success. Consider dedicating specific blocks of time to freelance work and prioritize tasks related to your startup goals. This disciplined approach will help you maximize both your income potential and progress towards launching your business.

Crowdfunding Campaigns

Crowdfunding has emerged as a popular method for raising capital, allowing startups to secure funding directly from the public. Platforms like Kickstarter and Indiegogo connect entrepreneurs with potential backers who contribute small amounts of money in exchange for rewards or equity, depending on the campaign type.

Key advantages of crowdfunding include: building early buzz and validating your product idea, gathering a community of early adopters, and accessing non-traditional funding sources. However, successful campaigns require careful planning and execution.

Consider these factors when exploring crowdfunding:

- Platform choice: Select a platform that aligns with your product and target audience.

- Compelling narrative: Craft a concise and persuasive story that resonates with potential backers.

- Reward structure: Offer attractive rewards that incentivize contributions.

- Marketing and outreach: Actively promote your campaign through social media and other channels.

While crowdfunding can be a viable option, it’s important to manage expectations. Not all campaigns reach their funding goals, and the process requires significant effort and dedication.

Preselling Your Product

Preselling is a powerful strategy to raise capital and validate your product idea before launching. It involves securing orders from customers before the product is actually manufactured or available. This generates revenue upfront, which you can then use to fund production or other startup costs.

Key benefits of preselling include mitigating financial risk, gauging market demand, and building early customer relationships. By offering early bird discounts or exclusive bonuses, you can incentivize customers to pre-order and create excitement around your launch.

Crowdfunding platforms are a popular avenue for preselling. Alternatively, you can set up a pre-order system directly on your website. Clearly communicate the product’s value proposition, estimated delivery date, and any associated risks with pre-ordering to maintain transparency and build trust with your early adopters.

Government Grants and Competitions

Government grants and competitions can provide valuable non-dilutive funding for startups. These programs are often industry-specific or focused on certain societal challenges.

Grants are essentially “free money” that does not need to be repaid, but they are highly competitive. A strong application highlighting your startup’s potential impact and alignment with the grant’s objectives is crucial.

Competitions, on the other hand, offer a chance to win funding and gain recognition by showcasing your business idea. Winning a competition can significantly boost your startup’s credibility and attract further investment.

Thorough research is essential to identify relevant grant opportunities and competitions. Be prepared to dedicate time and effort to crafting a compelling application or presentation.

Business Credit Cards

Business credit cards offer a readily available line of credit for startup expenses. They can be a valuable tool for managing cash flow and covering short-term costs. Interest rates are a key factor to consider. Shop around for the best rates and terms before committing to a card.

A key advantage is the potential to build business credit. Responsible use, such as paying balances on time and in full, helps establish a positive credit history for your business. This can be beneficial for securing future financing.

Be aware of potential fees associated with business credit cards. These may include annual fees, balance transfer fees, and late payment fees. Carefully review the terms and conditions to understand all associated costs.

Credit limits on business cards can vary significantly. Starting limits may be lower than desired, but can increase over time with responsible use and growth of your business. Monitor your credit utilization to maintain a healthy credit score.

Startup Incubators and Accelerators

Incubators and accelerators offer another avenue for funding, though indirectly. They don’t typically provide direct cash investments like venture capitalists. Instead, they provide resources such as mentorship, office space, networking opportunities, and educational programs.

Incubators nurture early-stage startups, helping them develop their business model and product. They often run for longer periods and don’t necessarily have a set curriculum. Acceptance into an incubator can provide validation and access to essential resources.

Accelerators, on the other hand, focus on rapidly scaling established startups. They usually involve a fixed-term program with a specific curriculum and mentorship from experienced entrepreneurs and investors. Accelerators often culminate in a “demo day” where startups pitch to potential investors.

While not direct funding, the resources, mentorship, and connections gained through these programs can be invaluable in attracting future investment and achieving sustainable growth. Many programs also offer seed funding as part of their participation agreement.

Family and Friends Support

Tapping into your personal network can be a viable option for initial funding. This involves seeking financial assistance from family members and close friends who believe in your venture. Clearly outline the terms of any such arrangement. Will it be a loan, or will they receive equity in your startup? A formal agreement, even with loved ones, is crucial to avoid misunderstandings and maintain healthy relationships.

Advantages of this approach include easier access to capital and potentially more flexible repayment terms. You might also find these investors more patient during the early stages of your business.

However, there are potential downsides to consider. Mixing business with personal relationships can strain those relationships if the business doesn’t perform as expected. Open and honest communication about the risks involved is paramount.