Choosing the right business structure is a crucial first step for any entrepreneur. The business structure you select will impact your legal liability, tax obligations, and administrative burden. Understanding the advantages and disadvantages of each business structure is essential for making an informed decision that aligns with your long-term business goals. This article will guide you through the process of evaluating the various business structures available, including sole proprietorship, partnership, Limited Liability Company (LLC), S corporation, and C corporation, to help you determine the most appropriate option for your specific needs.

Navigating the complexities of choosing a business structure can be daunting. From the simplicity of a sole proprietorship to the more complex structure of a C corporation, each option presents unique considerations. Factors such as the number of owners, desired level of liability protection, anticipated growth, and tax implications all play a significant role in determining the optimal business structure. By carefully considering these factors and understanding the characteristics of each business structure, you can lay a solid foundation for your business’s future success.

Why Business Structure Matters

Choosing the right business structure is a critical decision that significantly impacts your business’s legal, tax, and operational aspects. It’s not a one-size-fits-all scenario; the optimal structure depends on various factors specific to your business.

The business structure you select influences your liability. Some structures offer personal liability protection, shielding your assets from business debts and lawsuits, while others do not.

Tax implications vary significantly depending on the structure. Different structures have different tax rates and filing requirements. Making the right choice can lead to substantial tax savings.

Your chosen structure also affects administrative burdens. Some structures require more complex paperwork and compliance procedures than others. Understanding these differences is crucial for efficient business operations.

Finally, your business structure can influence your ability to raise capital. Certain structures, like corporations, offer more options for attracting investors.

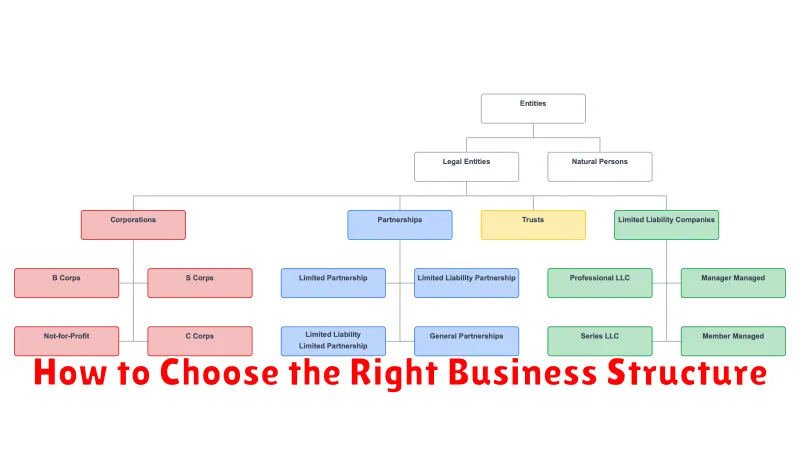

Types of Structures Available

Choosing the right business structure is a crucial decision that impacts legal, tax, and operational aspects. Several primary structures exist, each with its own advantages and disadvantages.

Sole Proprietorship

This structure is the simplest to establish, involving a single owner who directly manages the business. Profits are taxed as personal income, but the owner bears full liability for business debts.

Partnership

Partnerships involve two or more individuals who agree to share in the profits or losses of a business. Similar to sole proprietorships, partners typically face personal liability.

Limited Liability Company (LLC)

LLCs offer the limited liability protection of a corporation while maintaining the flexibility and tax benefits of a partnership. Owners, known as members, are not personally liable for business debts.

Corporation (C Corp and S Corp)

Corporations are more complex, considered separate legal entities from their owners. C Corps face double taxation (corporate and individual), while S Corps allow profits and losses to be passed through directly to the owners’ personal income without being subject to corporate tax rates.

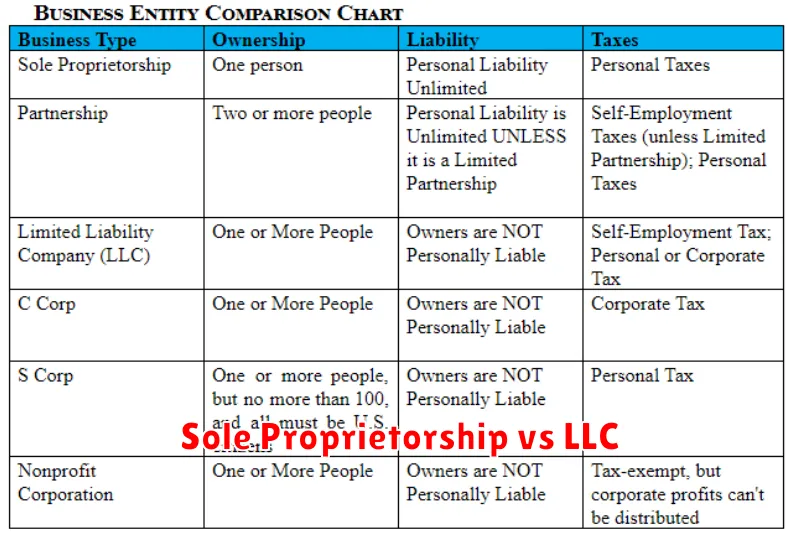

Sole Proprietorship vs LLC

Choosing between a sole proprietorship and a Limited Liability Company (LLC) is a crucial step for new business owners. Both structures offer distinct advantages and disadvantages, primarily concerning liability, taxation, and administrative burden.

Liability

A sole proprietorship offers no legal distinction between the owner and the business. This means the owner is personally liable for all business debts and obligations. An LLC, however, provides limited liability, shielding the owner’s personal assets from business debts and lawsuits.

Taxation

Sole proprietorships report business income on their personal tax returns, avoiding corporate taxes. LLCs offer flexibility. By default, they are taxed like sole proprietorships, but they can elect to be taxed as S corporations or C corporations.

Administrative Burden

Sole proprietorships are generally easier to set up and operate, with less paperwork and fewer formalities. LLCs require more complex setup procedures, including filing articles of organization with the state and potentially adhering to ongoing compliance requirements.

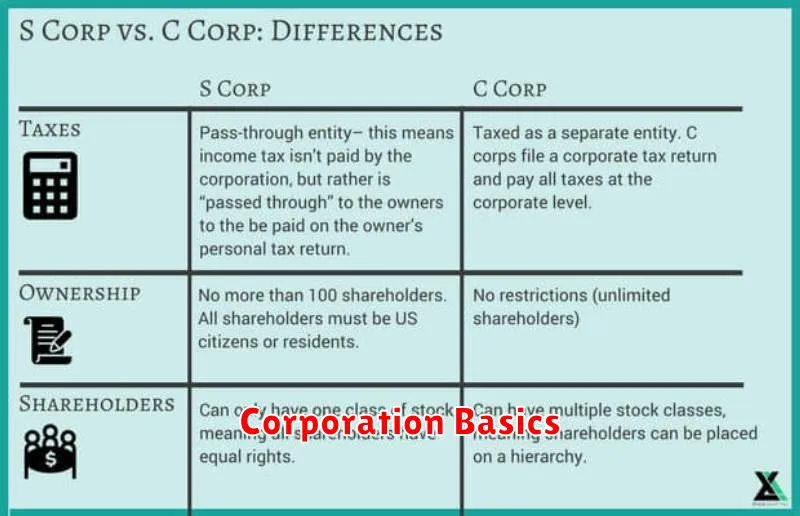

Corporation Basics

A corporation is a complex business structure that is legally separate from its owners, offering liability protection. This means the personal assets of the owners are generally not at risk for business debts or lawsuits.

Corporations are more formal than other structures and require strict adherence to regulations, including regular meetings, record-keeping, and reporting. They can issue stock, which can be a powerful tool for raising capital.

There are different types of corporations, including S corporations and C corporations, each with its own tax implications. C corporations face double taxation, meaning profits are taxed at the corporate level and again when distributed to shareholders as dividends. S corporations avoid this by passing income directly to shareholders.

Choosing the right type of corporation depends on various factors, including the size and nature of the business, the number of owners, and long-term goals. Consulting with a legal and financial professional is crucial to making an informed decision.

Tax Considerations for Each Structure

Choosing the right business structure has significant tax implications. Understanding these differences is crucial for minimizing your tax burden and ensuring compliance.

Sole Proprietorship/Partnership

Profits are taxed at the individual owner’s income tax rate. This is often referred to as pass-through taxation. The business itself does not file a separate tax return.

Limited Liability Company (LLC)

LLCs also benefit from pass-through taxation, similar to sole proprietorships and partnerships. However, LLCs offer more flexibility and can sometimes elect to be taxed as an S corporation or C corporation.

S Corporation

S corporations also have pass-through taxation, but owners can take some of their income as a salary and some as a distribution, potentially lowering their overall tax liability. Understanding reasonable compensation is critical for S corp owners.

C Corporation

C corporations face double taxation. The corporation pays taxes on its profits, and then shareholders pay taxes again on any dividends they receive. While this can be a disadvantage, C corporations may offer other benefits depending on the specific business goals.

Liability and Ownership Rules

Liability and ownership structures vary significantly among different business entities. Understanding these differences is crucial when choosing the right structure for your business.

Sole proprietorships and partnerships offer simple setup but expose owners to personal liability for business debts and obligations. This means personal assets are at risk.

Limited Liability Companies (LLCs) and corporations provide limited liability, shielding personal assets from business liabilities. This separation offers greater protection for owners.

Ownership is also structured differently. Sole proprietorships have one owner, partnerships have two or more, while LLCs and corporations can have multiple owners with varying levels of control depending on the operating agreement or corporate bylaws.

How to Make the Best Choice

Selecting the optimal business structure requires careful consideration of several key factors. Understanding your business goals, financial situation, and risk tolerance is paramount.

Liability protection is a crucial element. Consider the level of personal liability you’re willing to accept. Sole proprietorships and partnerships offer less protection than Limited Liability Companies (LLCs) or corporations.

Tax implications vary significantly between structures. Some structures allow pass-through taxation, while others face corporate tax rates. Consult with a tax professional to determine the most advantageous option for your specific circumstances.

Administrative burden also differs. Corporations, for instance, require more complex record-keeping and compliance procedures than sole proprietorships. Evaluate the amount of time and resources you can dedicate to administrative tasks.