Creating a business budget is a crucial step for any business owner, regardless of size or industry. A well-defined budget acts as a financial roadmap, guiding your spending, allocating resources, and ultimately contributing to the financial success of your business. This comprehensive guide outlines the essential steps involved in developing a business budget that works, ensuring your business stays financially healthy and achieves its financial goals. Learning how to set up a budget will provide valuable insights into your company’s cash flow, allowing you to make informed decisions and plan for future growth. By understanding the core components of a successful budget, you can gain control over your finances and pave the way for long-term profitability.

Whether you’re a startup navigating initial expenses or an established business seeking to optimize spending, a functional business budget is an indispensable tool. This guide will equip you with the knowledge and practical strategies needed to create a budget that aligns with your specific business needs. We will cover key aspects such as forecasting revenue, identifying and categorizing expenses, and establishing realistic financial targets. By implementing these techniques, you can transform your business budget from a static document into a dynamic instrument that empowers you to monitor performance, identify areas for improvement, and make data-driven decisions that drive business growth and financial stability.

Why Every Business Needs a Budget

A budget is a critical tool for managing finances in any business, regardless of its size or industry. It acts as a roadmap, guiding financial decisions and helping businesses achieve their financial goals. Without a budget, a business operates without a clear financial direction, increasing the risk of overspending, missed opportunities, and potential financial instability.

Improved Financial Control is a key benefit of budgeting. By tracking income and expenses, businesses gain a clearer understanding of their cash flow. This allows for better allocation of resources and more informed decision-making.

Budgeting also plays a crucial role in Setting and Achieving Financial Goals. Whether it’s expanding operations, investing in new equipment, or increasing profitability, a budget provides a framework for setting realistic targets and monitoring progress towards those goals.

Furthermore, a well-defined budget is essential for Securing Funding. Lenders and investors often require a detailed budget as part of the due diligence process. A comprehensive budget demonstrates financial stability and responsible management, increasing the likelihood of securing financing.

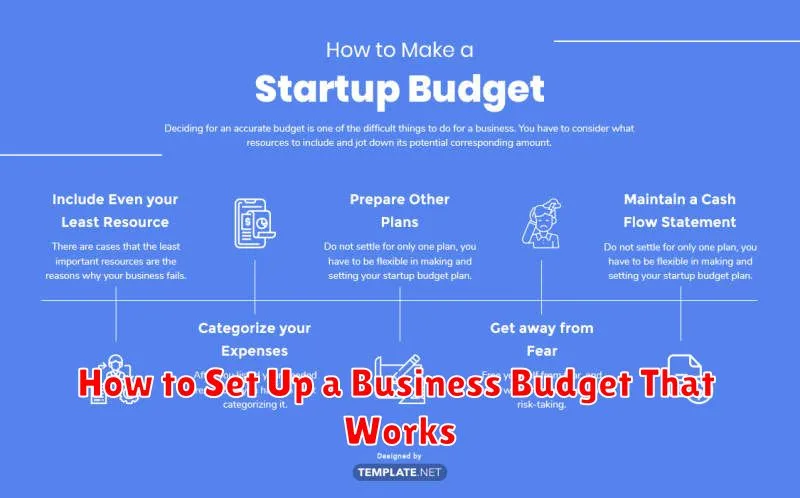

Steps to Create a Basic Budget

Creating a basic budget involves several key steps. First, calculate your income. This includes all revenue streams for your business. Be sure to use realistic figures.

Next, identify and list your expenses. Categorize them as fixed (e.g., rent, salaries) or variable (e.g., marketing, raw materials). Be thorough and include even small expenses.

Then, subtract your total expenses from your total income. A positive result indicates a profit, while a negative result indicates a loss. This is your net income.

Finally, review and adjust your budget regularly. Business conditions change, so your budget should be a dynamic document. Monitor your actual spending against your budget and make adjustments as needed.

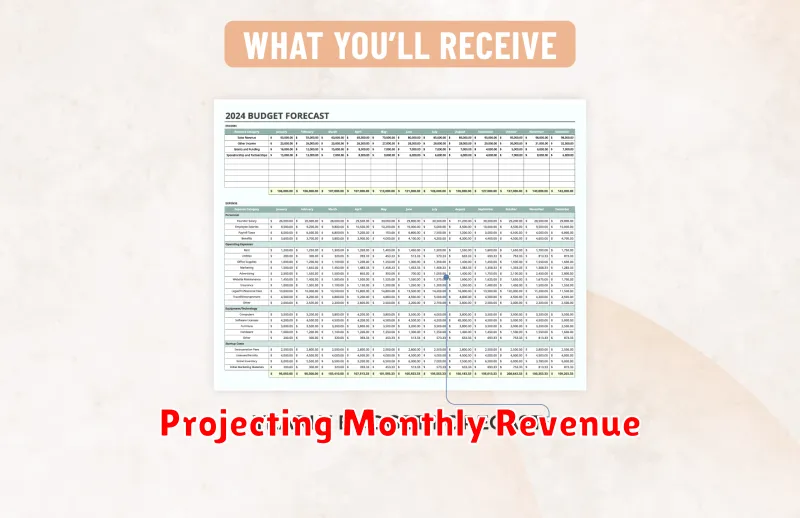

Projecting Monthly Revenue

Projecting monthly revenue is a critical step in building a functional business budget. Accurate revenue projections inform spending decisions and provide a benchmark against which to measure performance.

Begin by considering your sales history. If you have existing data, analyze past trends to inform future expectations. Factor in any seasonality or cyclical patterns that may impact sales.

For new businesses, market research is essential. Understanding your target market, pricing strategies, and competitive landscape will allow you to develop realistic revenue projections. Consider conducting surveys, competitor analysis, and industry research.

Break down your revenue projections by product or service. This granular approach helps pinpoint potential areas for growth or weakness. For example:

| Product/Service | Projected Units Sold | Price per Unit | Total Revenue |

|---|---|---|---|

| Product A | 100 | $25 | $2,500 |

| Service B | 50 | $50 | $2,500 |

Regularly review and adjust your projections as needed. Market conditions, unforeseen circumstances, and business performance can all influence revenue. Staying flexible and updating your projections ensures your budget remains relevant and useful.

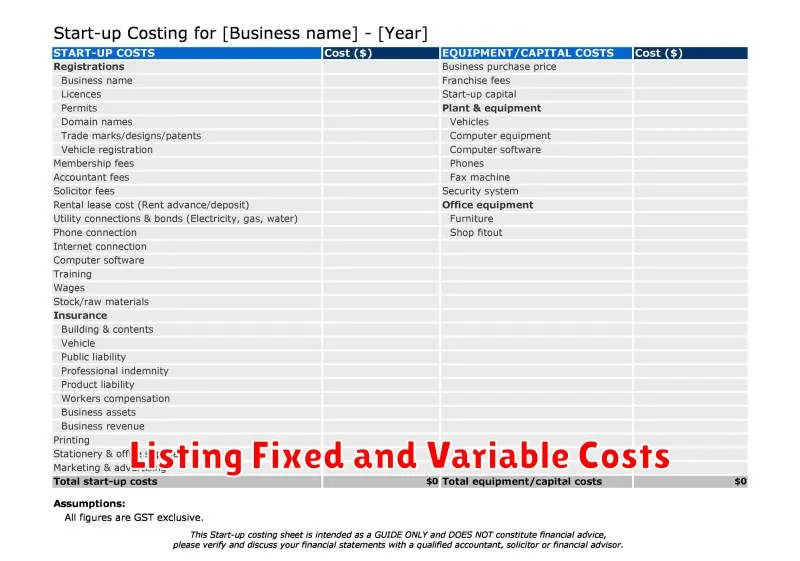

Listing Fixed and Variable Costs

Creating a practical business budget requires a clear understanding of your expenses. A key step is differentiating between fixed costs and variable costs. Accurately categorizing these expenses allows for better forecasting and resource allocation.

Fixed Costs

Fixed costs remain constant regardless of your production or sales volume. These are the expenses you incur even if you sell nothing. Common examples include:

- Rent or mortgage payments

- Salaries of permanent staff

- Insurance premiums

- Loan repayments

Variable Costs

Variable costs fluctuate directly with your production or sales volume. The more you produce or sell, the higher these costs will be. Examples include:

- Raw materials

- Packaging

- Sales commissions

- Shipping costs

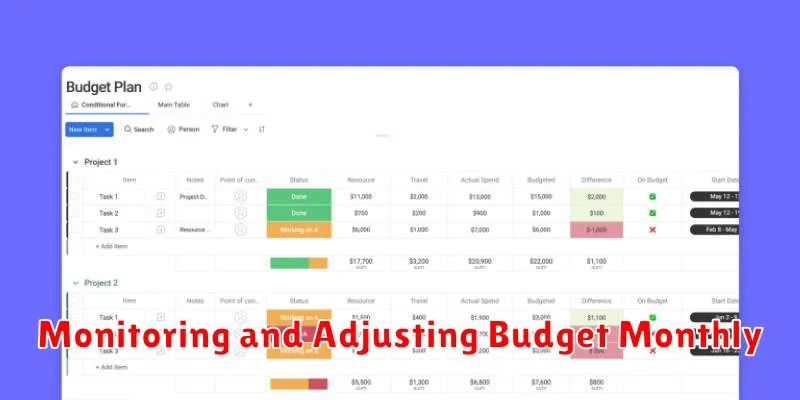

Monitoring and Adjusting Budget Monthly

Budget monitoring is crucial for maintaining financial stability and achieving business objectives. Regular review allows for identifying discrepancies between projected and actual figures.

Monthly monitoring is recommended. This frequency provides enough data to spot trends and react to changes without being overly time-consuming. Compare your actual income and expenses against your budgeted figures. Analyze any variances, both positive and negative.

Budget adjustment is the natural next step. If income consistently falls short or expenses exceed projections, adjustments are necessary. This might involve reducing discretionary spending, exploring new revenue streams, or renegotiating contracts.

Remember, a budget is a dynamic tool. It should be regularly reviewed and adjusted to reflect the changing realities of your business environment. This consistent monitoring and adjustment will ensure your budget remains relevant and effective in guiding your financial decisions.

Common Mistakes to Avoid

Creating a functional business budget requires diligence and attention to detail. Avoiding common pitfalls is crucial for its success. Here are some frequent mistakes to watch out for:

Unrealistic Revenue Projections

Overestimating potential income is a common mistake. Be realistic about sales forecasts and market conditions. Base projections on solid data and research.

Ignoring Indirect Costs

Factor in all expenses, not just the obvious ones. Consider indirect costs like administrative overhead, marketing, and professional fees. These can significantly impact your bottom line.

Lack of Flexibility

Your budget should be a living document. Don’t be afraid to adjust it as needed. Market changes, unexpected expenses, and new opportunities may require flexibility in your budgeting.

Neglecting Regular Review

Regularly review and update your budget. Monthly or quarterly reviews help track progress, identify discrepancies, and make necessary adjustments for long-term financial health.